Does Homeowners Insurance Cover Hardwood Floor Damage? Essential

Homeowners insurance may cover hardwood floor damage if it results from a sudden, accidental covered peril, like a burst pipe or fire. Damage from gradual wear, pet accidents, or lack of maintenance is usually excluded. Always check your specific policy declarations page and call your agent for definitive coverage answers.

When beautiful hardwood floors suddenly look ruined, it can feel like a total disaster. You probably spent a lot of time and money picking out that perfect oak or maple. Seeing deep scratches, water stains, or warped boards makes anyone worry about the repair bill.

The big question always pops up: Will my homeowner’s insurance step in to help fix this flooring nightmare? It’s frustrating not knowing if you’re covered when accidents happen.

Don’t worry! As a fellow DIY enthusiast, I’ve navigated the tricky world of insurance paperwork before. We are going to break down exactly what insurance policies typically cover and, more importantly, what they leave out when it comes to your wood floors. Let’s dive in and get clear answers so you can move forward with confidence.

Understanding Your Homeowners Insurance Policy: The Basics

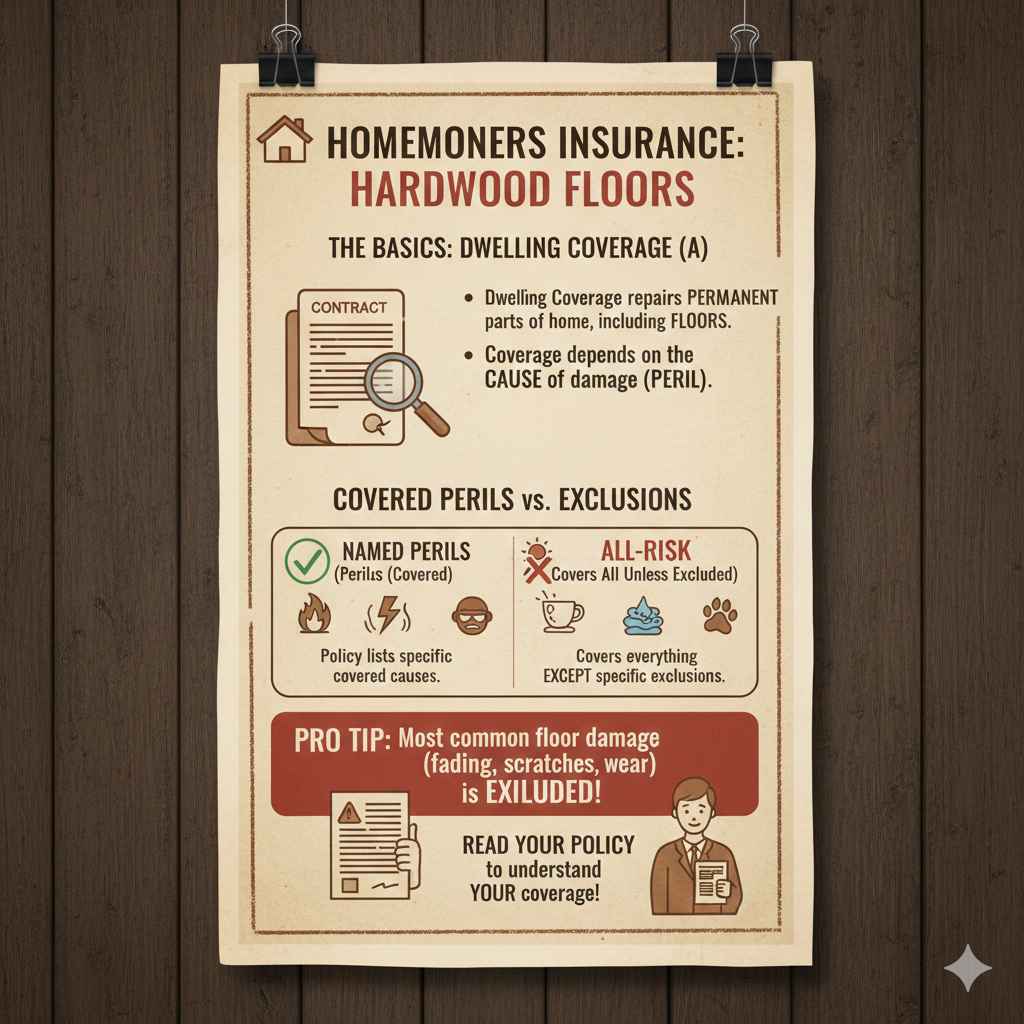

Before we look specifically at hardwood, we need a quick refresher on how insurance actually works. Think of your homeowner’s policy as a contract divided into key sections. For flooring, we are mainly concerned with your Dwelling Coverage (Coverage A).

Dwelling Coverage pays to repair or rebuild the structure of your home, which includes things permanently attached to it—like your hardwood floors. But here is the crucial part: coverage is tied to the cause of the damage, known in the industry as the “peril.”

The Concept of Covered Perils vs. Exclusions

Insurance policies operate on one of two main structures:

- Named Perils: If your policy only lists specific perils it covers (like fire, windstorm, theft), it only pays for damage caused by those named items.

- All-Risk (Open Perils): This is more common today for Dwelling Coverage. It covers everything unless the cause of loss is specifically excluded in the policy language.

Since hardwood floors are permanent fixtures, damage caused by a covered peril generally means the floor is covered under your Dwelling Coverage. However, the causes of damage we see most often—like sunlight fading or years of dog scratches—fall squarely into the “excluded” list.

When Homeowners Insurance DOES Cover Hardwood Floor Damage

This is the good news! If a sudden, unexpected event listed in your policy causes the destruction, your insurance company should step up to help replace or refinish those beautiful floors. Here are the most common scenarios where you’ll likely find coverage:

1. Sudden and Accidental Water Damage

Water is the number one enemy of hardwood. If water soaks in, the wood swells, warps, cups, or permanently stains, it usually needs replacement.

Coverage applies when the source of water is sudden and accidental. Examples include:

- A pipe suddenly bursting behind a wall or under the floor.

- A washing machine hose rupturing during the night.

- Sudden, unexpected overflow from a bathtub or toilet.

- Firefighting efforts (the water used by the fire department).

Key Tip: If the water damage is gradual—like a slow, years-long leak from an aging toilet seal—it might be denied because insurance assumes you should have noticed and fixed it sooner.

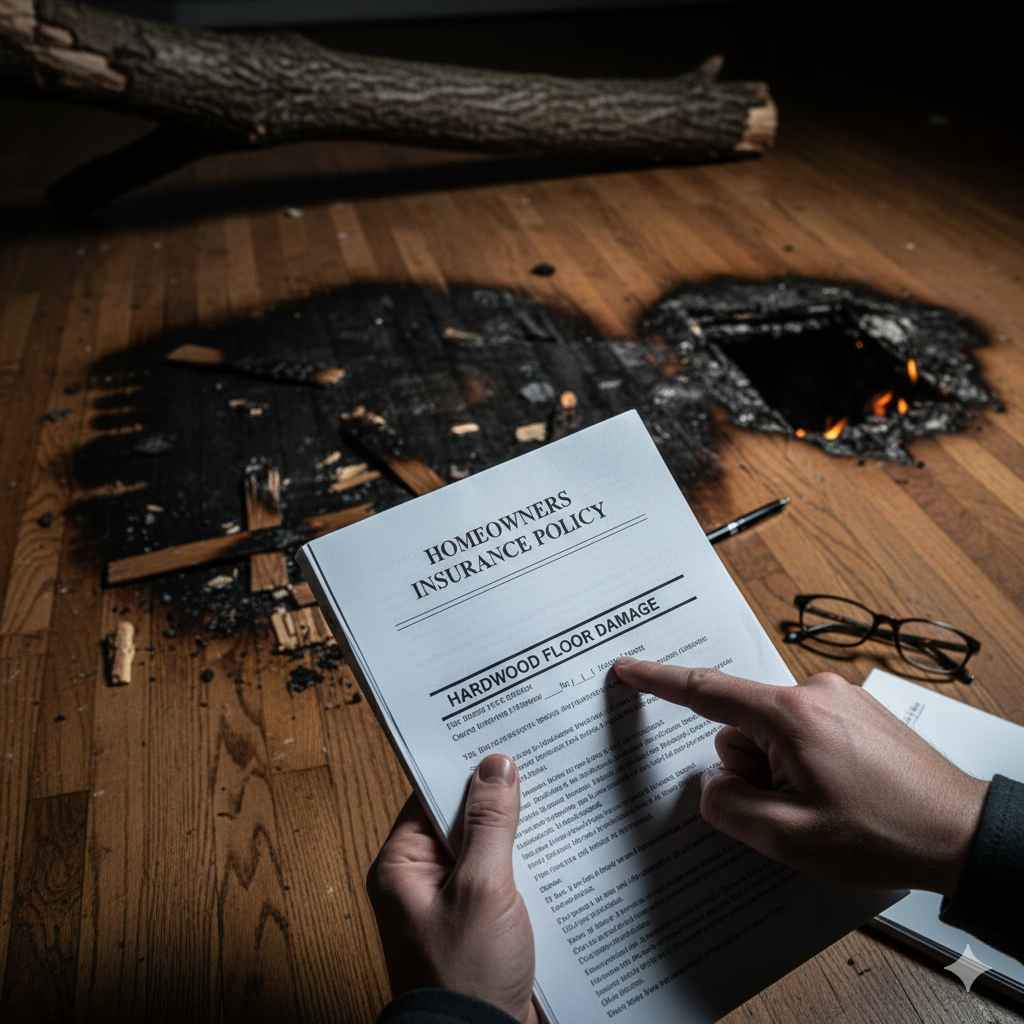

2. Fire, Lightning, and Smoke Damage

If a fire starts, whether due to an electrical short or lightning strike, the resulting heat, charring, and smoke contamination will severely damage hardwood floors. Since fire is a standard “named peril” in nearly every policy, the resulting floor damage is almost always covered.

Smoke residue can penetrate the wood grain and cause lingering odors and discoloration that go beyond simple cleaning. In these cases, replacement or professional remediation is usually covered.

3. Hail, Windstorms, and Falling Objects

If a severe storm rips off part of your roof or causes a tree limb to crash through your ceiling, the debris and resulting rain/weather exposure will ruin the floors underneath.

This type of damage is covered under wind or falling object perils. You might need to address the roof first, but the resulting damage to the floor structure will be included in the claim.

4. Vandalism or Theft Damage

While rare, if someone breaks into your home and intentionally scratches, gouges, or burns your floors (vandalism), that damage is typically covered under specific peril sections related to malicious mischief. Damage from breaking and entering (e.g., kicked-in door jambs that damage adjacent flooring) is also generally included.

When Homeowners Insurance Will Likely NOT Cover Hardwood Floor Damage

This is where many homeowners get surprised, often thinking “accidents happen,” so insurance should cover all accidents. However, insurance is designed for unpredictable, sudden events, not predictable maintenance issues. If the damage occurred slowly or was caused by neglect, you are usually responsible.

1. Gradual Wear and Tear (Maintenance Issues)

Hardwood floors are beautiful, but they require care. If your floors show faded areas where area rugs used to be, or if they have countless shallow scratches from everyday living, that is considered wear and tear. Insurance does not cover the normal aging process of your home.

2. Pet Damage (Scratches and Urine Stains)

This is a common point of frustration for pet owners. Deep scratches left by dogs are almost universally excluded as they are considered routine maintenance/wear. More significantly, pet urine stains can penetrate deep into the wood and the subfloor. While water damage is covered, urine damage is often excluded because the acidity and chemical nature of the stain are viewed differently than plain water.

Note: If the urine saturated the subfloor so badly that mold grew, some policies might cover the mold remediation, but rarely the floor replacement itself unless it ties directly to a covered peril.

3. Intentional Damage or Alterations

If you, a contractor, or a family member tried to refinish the floor and made a huge mistake (like stripping the finish incorrectly, leading to discoloration), that is your responsibility. Insurance does not cover bad DIY work or deliberate actions.

4. Insect or Infestation Damage

Termites, powderpost beetles, and carpenter ants cause slow, structural damage over time. Because this damage is not sudden, it falls under exclusions for infestation or decay. To cover this, you would need special endorsements on your policy, which are not standard.

5. Flood Damage

This is critical! Standard homeowners insurance policies explicitly exclude damage caused by flooding, which is defined as water rising from the ground (outside your home) or overflowing rivers/lakes. If your basement floods due to heavy rain washing over the land, your hardwood floors will not be covered unless you separately purchased a National Flood Insurance Program (NFIP) policy or a private flood policy.

If you suspect your hardwood floor damage is covered, taking the right steps immediately is essential for a smooth claim. I’ve seen homeowners sabotage their own claims by waiting too long or cleaning up too much!

Step-by-Step Guide to Filing a Hardwood Floor Claim

- Safety First: If the damage involves electrical issues, fire, or major structural damage, contact professionals immediately for safety.

- Stop Further Damage: If it’s a water leak, turn off the main water valve if you know where it is. Cover broken windows or roofing areas with tarps to prevent more rain from getting in. This action is required by most policies—it shows you tried to mitigate the loss.

- Document Everything: This is non-negotiable. Take high-resolution photos and videos of the damaged flooring before you move furniture or start any cleanup. Take pictures from several angles and show the source of the damage if possible (e.g., the broken pipe).

- Call Your Agent: Contact your insurance agent or the company hotline as soon as you realize the damage is significant. Be honest about what happened.

- Wait for the Adjuster: Do not authorize major replacement or refinishing work until the insurance adjuster has inspected the damage. They need to verify the cause and scope of loss.

- Get Multiple Quotes: Once the adjuster approves the scope, get at least two detailed estimates from reputable flooring contractors familiar with insurance claims.

Assessing the Damage: Refinishing vs. Replacement

Even when the cause is covered (like a major water leak), the insurance company won’t just automatically pay to install brand-new floors. They only pay for what is necessary to restore the damaged area to its pre-loss condition.

This often comes down to whether refinishing is possible or if full replacement is required. This assessment heavily influences your payout.

Table 1: Hardwood Floor Damage Scenarios and Likely Coverage Outcomes

| Damage Scenario | Typical Insurance Coverage Outcome | Reasoning |

|---|---|---|

| Pipe burst causing standing water for 12 hours. | Replacement (Covered) | Sudden peril; wood warped beyond practical refinishing. |

| Dog scratches visible in main traffic areas. | No Coverage (Excluded) | Considered maintenance/wear and tear. |

| Heavy appliance dropped, causing deep gouge. | Partial Coverage (Repair/Refinishing) | Sudden, accidental damage may be covered under contents or dwelling, depending on the item. |

| Water damage from underground sewer backup. | No Coverage (Flood Exclusion) | Requires a separate Flood Insurance policy endorsement. |

| Damage from falling ceiling insulation during renovation. | Usually Covered | Accidental physical loss, often covered under debris removal/dwelling. |

Understanding Matching Difficulties

A major headache when dealing with partial floor replacement is matching the wood. If only three rooms are affected by a pipe burst, the adjuster needs to account for two major factors:

- Color and Finish: New wood won’t match old, UV-exposed wood.

- Thickness/Milling: Older homes may have different thicknesses or species that are no longer readily available.

If the flooring company cannot find an exact match, insurance usually agrees to pay for refinishing the entire contiguous area (like the whole first floor) to ensure a uniform look. This is called “matching” and is a key negotiation point in any floor claim.

Endorsements and Riders: Beefing Up Your Coverage

If you live in an older home or worry specifically about certain types of damage, you might need to customize your standard policy with endorsements. These riders add specific types of coverage not included in the basic form.

Water Backup Endorsement

Standard policies exclude water damage that backs up through sewers or drains. If your basement flooded because of a clogged municipal sewer line backing up into your floor drains, this specific endorsement is crucial for covering hardwood damage in those areas.

Ordinance or Law Coverage (Coverage X)

This is vital for older homes with hardwood. Sometimes, damage requires a full replacement, but local building codes (ordinances) require you to use materials or installation methods that are now more expensive than the original cost of the floor.

For example, if your 1950s subfloor doesn’t meet modern shear wall requirements for new construction, you may need newer (more expensive) underlayment. Ordinance or Law coverage pays for these required code upgrades, ensuring the repair meets today’s standards without depleting your primary dwelling limit.

Sewer Line Coverage

While often tied into water backup, some companies offer specific riders for damage caused by the failure of your private sewer or drain lines, which can sometimes seep water up into lower-level hardwood floors.

For more information on what homeowners policies commonly include, resources like the Insurance Information Institute (III) provide excellent, non-biased overviews of standard policy language.

DIY vs. Professional Repair: Making the Right Call

As someone who loves to tackle projects myself, I know the temptation is strong to just cover the damage and start sanding! However, when insurance is involved, how you proceed matters immensely.

When You Can Handle Minor Repairs Yourself

If the damage is superficial and clearly limited to a small area that doesn’t affect the structural integrity or moisture content of the wood, you might choose to fix it yourself to avoid making a claim.

Minor, self-repairable scenarios:

- Light scratches that can be blended with furniture markers or touch-up kits.

- Dings caused by dropped tools that are shallow enough for spot-filling with wood putty and spot-refinishing only that board.

If the cost is under your deductible—say $1,000—and you know you can fix it perfectly for $200, skip the claim entirely. Claims history affects your future rates.

Why You Need Professionals for Major Water/Fire Damage

When water soaks hardwood, the damage isn’t just what you see on the surface. The wood can delaminate, the moisture can wick into the subfloor (plywood or concrete underneath), and mold can begin growing within 48 hours.

Professionals can utilize specialized equipment:

- Moisture Meters: To check the actual moisture content deep within the planks and the subfloor. This proves to the adjuster if replacement is necessary.

- Drying Equipment: High-powered dehumidifiers and air movers to dry the structure quickly and prevent mold growth.

- Moisture Barriers: To prevent moisture transfer from the concrete slab below if you have a basement.

Trusting the process to a contractor who understands insurance claims speeds things up and ensures the underlying structural issue is solved, which is vital for long-term floor health.

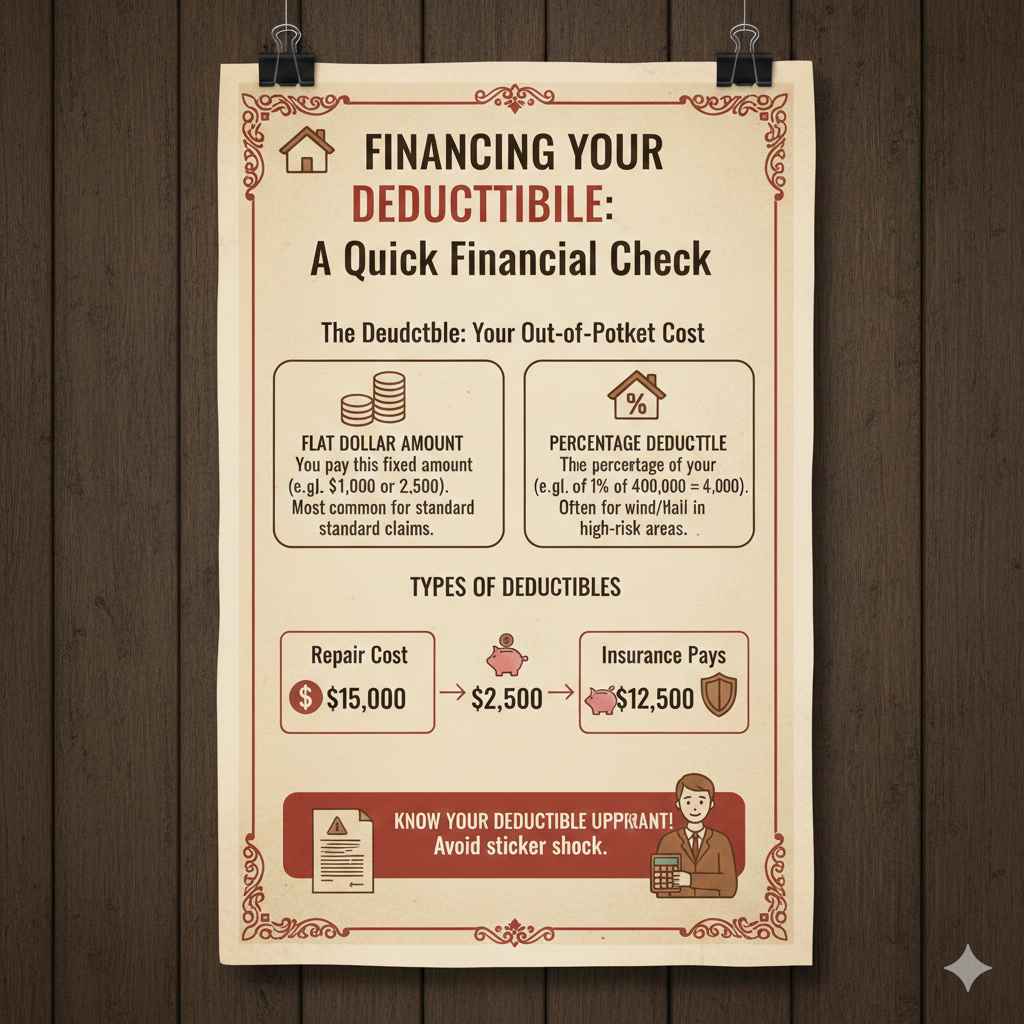

Financing Your Deductible: A Quick Financial Check

Remember, every policy has a deductible—the amount you pay out-of-pocket before the insurance coverage kicks in. This is usually structured in one of two ways:

Table 2: Types of Deductibles

| Deductible Type | What It Means for Your Claim | When It Applies |

|---|---|---|

| Flat Dollar Amount ($1,000 or $2,500) | You pay this fixed amount regardless of the damage type (e.g., fire or water). | Most common for standard Dwelling Coverage claims. |

| Percentage Deductible (1% or 2% of Dwelling Coverage) | If your home is insured for $400,000, a 1% deductible is $4,000. | Often applied specifically to wind/hail damage in high-risk areas (coastal or tornado-prone zones). |

If your deductible is $2,500, and the insurance adjuster determines the repair cost is $15,000, your insurance pays $12,500, and you are responsible for the initial $2,500. Knowing this figure upfront prevents sticker shock when the repair bill arrives.

FAQ: Quick Answers for Hardwood Floor Insurance Concerns

Q1: How do I prove my floor damage wasn’t gradual wear and tear?

A: You must clearly show the sudden event. If a pipe bursts, photograph the pipe and the pooling water immediately. If the damage is widespread but you can pinpoint when the leak started (e.g., when you heard the dripping sound), document that timeline for the adjuster.

Q2: If my insurance covers the damage, do they pay for the brand of hardwood I want now?

A: Generally, no. Insurance pays for what is “comparable”—meaning similar quality and construction to what you had before. If you want a much more expensive, exotic wood now, you will pay the difference above what the adjuster approves.

Q3: Is refinishing a covered repair, or does it have to be full replacement?

A: Refinishing is usually covered if the damage (like minor smoke staining or light water exposure) only affects the top coat or the top layer of the wood finish, and the structure of the wood itself remains sound.

Q4: Do I need to remove damaged flooring immediately before the adjuster visits?

A: No! Wait until the adjuster has documented the scene. Removing materials prematurely can look like you are hiding something or attempting unauthorized repairs. Only take action necessary to prevent further immediate loss, like stopping a leak.

Q5: What if I stained my floors trying to clean them up after a small incident?

A: Unfortunately, self-inflicted damage during cleanup is usually excluded. Insurance companies expect homeowners to follow basic cleanup guidelines—dab liquids, don’t scrub them in—when dealing with minor accidents before filing a large claim.

Q6: If squirrels chew through wires causing a fire that damages my floors, is that covered?

A: Yes. Fire is a covered peril. While the cause was an animal (which might be excluded separately), the direct damage came from the resulting fire. The fire damage to the floors would almost certainly be covered under Dwelling Coverage.

Conclusion: Protecting Your Investment and Moving Forward

Hardwood floors are a significant investment in your home’s beauty and value. Knowing your insurance policy’s stance on floor damage empowers you to handle accidents confidently. Remember the key takeaway: coverage hinges almost entirely on the cause of loss.

If the damage is sudden, accidental, and caused by a peril listed in your policy—think burst pipes, fire, or wind—you have a strong case for coverage. If it’s slow, hidden, or related to maintenance—like pet scratching or long-term leaks—you’ll likely be responsible for the repair bill.

My best advice, as your DIY mentor, is to take an hour this week to pull out your policy documents. Locate your Coverage A limits and look specifically at the section titled “Perils Excluded.” Being prepared beforehand—knowing your deductible and understanding what risks you carry—is the best renovation you can do for your peace of mind. You’ve got this!