What Is TARP Bailout? A Deep Dive into the 2008 Financial Rescue for Automotive Fans

Hey there, friend! So, you’re curious about what is TARP bailout is. I’m excited to chat about this because it’s a big piece of history that hit the automotive world hard, and it’s something I’ve dug into while geeking out over cars and economics. Back in 2008, I was fixing up my old Chevy when I heard about this massive government plan to save banks, car companies, and the economy. It felt like the world was falling apart, and TARP was the lifeline everyone was talking about.

Whether you’re a car enthusiast, a DIY mechanic, or just someone who wants to know how this bailout saved brands like GM and Chrysler, I’ve got you covered. Let’s sit down, like we’re in your garage with a cold soda, and I’ll break it down in simple, clear steps. This guide is packed with insights for anyone in the USA wanting to understand TARP and its impact on cars. Ready to rev up and explore? Let’s roll!

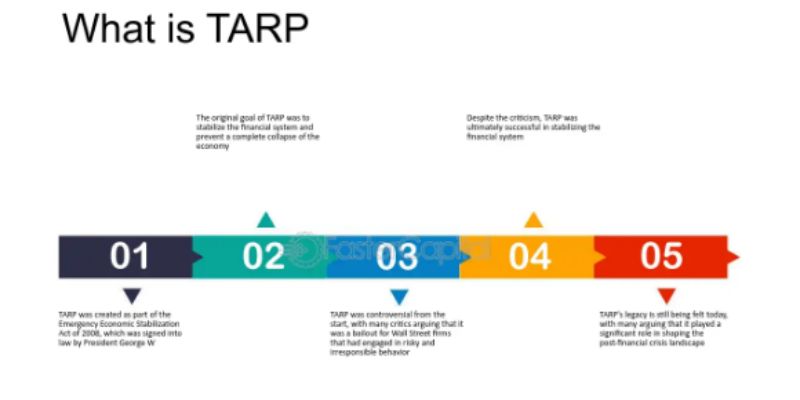

What Was the TARP Bailout?

TARP stands for Troubled Asset Relief Program. It was a government plan launched in 2008 to save the U.S. economy during a huge financial crisis. I remember watching the news, stunned, as banks, car companies, and even insurance giants were on the brink of collapse. The government stepped in with TARP to buy “troubled assets”—things like bad mortgages and failing bank stocks—to keep these companies afloat.

Signed into law by President George W. Bush on October 3, 2008, TARP started with $700 billion to spend. Later, it was cut to $475 billion. The goal was to stabilize banks, restart lending, save jobs, and stop foreclosures. For us car folks, TARP was huge because it poured money into General Motors and Chrysler to keep them from going bankrupt. It was a wild time, and TARP was like a giant wrench trying to fix a broken engine.

Why Was TARP Needed?

The 2008 financial crisis was a mess. I was working on my truck when I heard about Lehman Brothers collapsing. It started with subprime mortgages—loans given to people who couldn’t afford them. Banks bundled these risky loans into securities and sold them. When homeowners defaulted, the securities crashed, and banks lost billions. Credit froze, meaning businesses and people couldn’t borrow money.

This hit the auto industry hard. People stopped buying cars because they were broke or scared. GM and Chrysler were bleeding cash, facing bankruptcy. I worried my favorite brands might vanish. TARP was created to thaw the credit markets, save banks, and rescue industries like automotive. Without it, we could’ve faced a second Great Depression. It was a scary time, but TARP aimed to stop the freefall.

How Did TARP Work?

TARP was like a financial toolbox with different programs. I was amazed at how it tackled so many problems. Here’s how it worked:

- Buying Troubled Assets: TARP was meant to buy toxic mortgages and securities from banks. This cleared their books so they could lend again. I pictured it like cleaning gunk out of a carburetor to make an engine run smoothly.

- Investing in Banks: Instead of just buying assets, TARP injected cash into banks by purchasing their stock. This gave banks money to lend and kept them from failing. I was shocked when the government became a shareholder in places like Citigroup!

- Saving the Auto Industry: TARP loaned billions to GM and Chrysler. This kept factories open and saved jobs. I’ll dive into this more later—it’s a big deal for car fans.

- Helping Homeowners: TARP funded programs to stop foreclosures. It didn’t work as well as hoped, but it tried to keep people in their homes.

- Rescuing AIG: TARP bailed out insurance giant American International Group with $67.8 billion. AIG’s failure would’ve tanked the economy further.

The U.S. Treasury ran TARP through its Office of Financial Stability. By 2010, no new funds could be spent, but the program kept managing repayments until 2023. It was a massive effort, and I was glued to the news watching it unfold.

TARP and the Automotive Industry

For us car lovers, TARP’s auto bailout was the headline. GM and Chrysler were in deep trouble. I remember hearing GM might go under, and it felt like losing a piece of American history. In December 2008, President Bush used TARP to loan $80.7 billion to the auto industry. Here’s how it broke down:

- General Motors: GM got $50.7 billion. It used the money to restructure, close plants, and cut jobs. By 2009, GM filed for bankruptcy but came out stronger. I was relieved when they kept making Chevys and Cadillacs.

- Chrysler: Chrysler received $12.5 billion. It also went bankrupt but merged with Fiat to survive. I still see Dodge trucks on the road today, thanks to TARP.

- Ally Financial: GM’s financing arm got $17.2 billion to keep car loans flowing. I used an Ally loan for my next car, so this hit home.

- Suppliers and Others: Some funds helped auto suppliers and smaller companies stay afloat.

The auto bailout saved over 1 million jobs, from factory workers to dealers. I visited a GM plant once, and the workers told me TARP kept their families fed. By 2014, the Treasury sold its GM and Chrysler stock, recovering all but $10.2 billion. It wasn’t perfect, but it kept the auto industry alive.

What Were Troubled Assets?

“Troubled assets” sounds technical, but it’s simple. These were mortgages and securities that lost value when the housing market crashed. I learned about this while researching why car sales tanked. Banks held these assets, like bad loans or mortgage-backed securities, that nobody wanted to buy. They were toxic because they could bankrupt whoever owned them.

TARP aimed to buy these assets to clean up bank balance sheets. For example, a bank with $1 billion in bad mortgages couldn’t lend money. TARP would buy those mortgages, giving the bank cash to lend again. In practice, TARP bought more bank stock than assets, but the idea was to fix the root problem. I found it wild that a car bailout tied back to home loans!

How Much Did TARP Cost?

TARP’s cost is a big question. I was curious if taxpayers got stuck with a huge bill. Here’s the breakdown:

- Total Spent: TARP disbursed $443.5 billion from 2008 to 2010. That’s less than the $475 billion cap.

- Money Recovered: By 2023, TARP collected $425.5 billion through repayments, stock sales, dividends, and interest. For example, banks paid back $376.4 billion, and AIG returned $72.8 billion.

- Net Cost: The final cost was $31.1 billion. Most of this came from housing programs, which were grants, not loans. The auto bailout lost $10.2 billion, but banks and AIG made profits.

- Profit or Loss?: The Treasury made $15.3 billion in raw profit, but inflation adjustments suggest a slight loss. I was surprised it wasn’t a bigger hit.

For us car folks, the $10.2 billion auto loss was worth it to save GM and Chrysler. I’d rather pay a small price than lose American car brands forever.

Who Got TARP Money?

TARP helped a wide range of companies. I was shocked at how many industries got a piece. Here’s who benefited:

- Banks: Over 700 banks got $236 billion, including giants like Citigroup and Bank of America. Smaller banks, like OneUnited, also got funds. I read that some banks didn’t need it but took it anyway!

- Auto Industry: GM, Chrysler, and Ally Financial got $80.7 billion. This kept car production rolling.

- AIG: The insurance company got $67.8 billion to avoid a domino effect on the economy.

- Housing Programs: $31 billion went to homeowners through programs like Making Home Affordable. I knew a neighbor who got help, but it wasn’t enough for everyone.

- Credit Markets: $27 billion restarted lending for credit cards, student loans, and auto loans. I used a post-TARP auto loan, so this mattered.

TARP touched nearly every part of the economy. I was amazed at how it connected car factories to Wall Street.

Pros of the TARP Bailout

TARP had big wins, and I saw some firsthand. Here’s why it worked:

- Saved the Economy: TARP stopped a total collapse. Banks started lending again, and the stock market recovered. I felt relieved when car sales picked up.

- Kept Jobs: Over 1 million auto jobs were saved, plus millions in banking and other sectors. My buddy at a Chrysler dealer kept his job because of TARP.

- Made Money: The Treasury earned profits on bank and AIG investments. I was impressed that taxpayers got most of their money back.

- Fast Action: TARP was launched quickly to stop the crisis. I remember how fast Congress acted—it was rare!

- Stabilized Cars: GM and Chrysler survived, keeping American brands alive. I still drive a GM truck, and I’m grateful for that.

TARP wasn’t perfect, but it pulled us back from the edge. I saw the auto industry bounce back, and that’s a big win.

Cons and Criticisms of TARP

Not everyone loved TARP, and I get why. I heard plenty of gripes at car meets. Here’s what people didn’t like:

- Wall Street Bailout: Many felt TARP rewarded banks for bad behavior. I was mad that bankers got bonuses while people lost their homes.

- Didn’t Help Homeowners Enough: TARP aimed to stop 4 million foreclosures but only saved 800,000. I knew folks who lost houses despite TARP.

- Moral Hazard: Bailing out banks made them think they could take risks again, expecting future rescues. I worry this could cause another crisis.

- Executive Bonuses: Banks paid $1.6 billion in bonuses with TARP money. I was furious hearing about million-dollar payouts during a recession.

- Unfairness: Big banks got more help than small ones or minorities. I read that black-owned banks were less likely to get TARP funds.

TARP saved the day, but left a bad taste for many. I felt torn—happy for car jobs but upset about Wall Street’s free pass.

TARP’s Impact on the Auto Industry Today

TARP’s auto bailout reshaped the car world. I see its effects every time I drive. GM and Chrysler are stronger now, with better cars like the Chevy Silverado and Dodge Ram. They cut costs, improved quality, and focused on trucks and SUVs. I test-drove a 2024 Chrysler Pacifica, and it’s worlds better than their 2008 models.

Ally Financial, saved by TARP, is a top auto lender. I got a great loan rate from them last year. The bailout also kept suppliers alive, ensuring parts for my repairs. However, some plants closed, and workers lost their jobs during restructuring. I met a GM retiree who was bitter about pension cuts. Overall, TARP gave the auto industry a second chance, but it wasn’t pain-free.

How Was TARP Managed?

The Treasury’s Office of Financial Stability ran TARP. I was curious about who kept track of all that money. They set up programs like the Capital Purchase Program for banks and the Automotive Industry Financing Program for cars. Special Inspector General Neil Barofsky oversaw TARP to catch fraud. I read his reports, which found 150+ cases of misuse, like fake investments.

TARP ended new spending in 2010, but repayments continued until 2023. The Treasury sold its last GM stock in 2014, closing the auto chapter. I was impressed by the oversight but shocked at how some companies misused funds. It showed how hard it was to manage a $443 billion program.

TARP’s Legacy

TARP’s legacy is mixed, and I still think about it when I see a GM truck. It saved the economy and the auto industry, but it didn’t fix everything. Housing stayed rough for years, and banks kept taking risks. I worry about “too big to fail” companies expecting bailouts again. On the flip side, TARP proved the government could act fast in a crisis. I’m grateful for the cars and jobs it saved, but I hope we learned to avoid another 2008.

Comparing TARP to Other Bailouts

TARP wasn’t the first bailout, and I looked into others for context. In 1984, the government bailed out Continental Illinois Bank, losing $1 billion. The 1980s savings and loan crisis cost $125 billion. TARP’s $31.1 billion loss was smaller, and it made profits on banks. I was surprised TARP did better than older bailouts, but it still sparked more debate because of its size and Wall Street focus.

Here’s a table comparing TARP’s auto bailout to other parts:

| Program | Amount Spent | Amount Recovered | Net Cost | Key Impact |

|---|---|---|---|---|

| Auto Industry | $80.7 billion | $70.5 billion | $10.2 billion | Saved GM, Chrysler, 1M+ jobs |

| Banks | $236 billion | $376.4 billion | -$140.4 billion (profit) | Stabilized financial system |

| AIG | $67.8 billion | $72.8 billion | -$5 billion (profit) | Prevented economic collapse |

| Housing Programs | $31 billion | Minimal | $31 billion | Limited foreclosure relief |

What I Learned from TARP

Exploring TARP taught me how connected cars are to the economy. A housing crash hurt banks, which hurt car sales, which nearly killed GM. TARP was a bold move to fix it all. I’m thankful it saved my favorite brands, but I’m uneasy about bailing out reckless banks. It’s a reminder to keep an eye on financial news, even as a car guy. I now check economic trends before buying a new ride.

Wrapping It Up with a Full Tank

Hey, buddy, you’re now a TARP bailout expert! From saving GM and Chrysler to stabilizing banks, you know how this $443 billion plan kept the economy—and our car brands—alive. I remember the panic of 2008, but now I smile seeing new Rams and Corvettes on the road, thanks to TARP. Grab a wrench, hit the garage, and feel proud knowing the history behind your ride. Whether you’re cruising a Chrysler or cheering for American jobs, TARP’s legacy lives on. Keep exploring, and I’m here rooting for you!

FAQ: Your Questions Answered

What is the TARP bailout?

TARP was a 2008 government program to save the economy by buying troubled assets and bailing out banks, car companies, and others.

Why did the auto industry need TARP?

GM and Chrysler were losing money fast during the 2008 crisis. TARP loaned them $80.7 billion to avoid bankruptcy.

Did TARP cost taxpayers money?

Yes, it cost $31.1 billion overall, but banks and AIG made profits. The auto bailout lost $10.2 billion.

Who got TARP money?

Banks like Citigroup, car companies like GM, insurer AIG, and homeowners got TARP funds.

Did TARP save jobs?

Yes, it saved over 1 million auto jobs and millions more in banking and other industries.

Was TARP a success?

It stabilized the economy and saved cars, but it didn’t help homeowners enough and rewarded some risky banks.

Why was TARP controversial?

People were mad that banks got bonuses and Wall Street was bailed out while many lost homes.